Global Gold Corp. (GBGD) faces additional struggles in Armenia in its ongoing effort to restart its flag ship TOUKHMANUK Gold Mine, operated by its subsidiary, MEGO-GOLD LLC.

Beyond having no money to operate, GBGD has not even secured a permit to build a new tailings dam.

On April 26, 2013. the Ministry of Energy and Nature Protection (MNP) of the Republic of Armenia REJECTED Mego-Gold's application for a tailings dam for the TOUKHMANUK GOLD MINE.

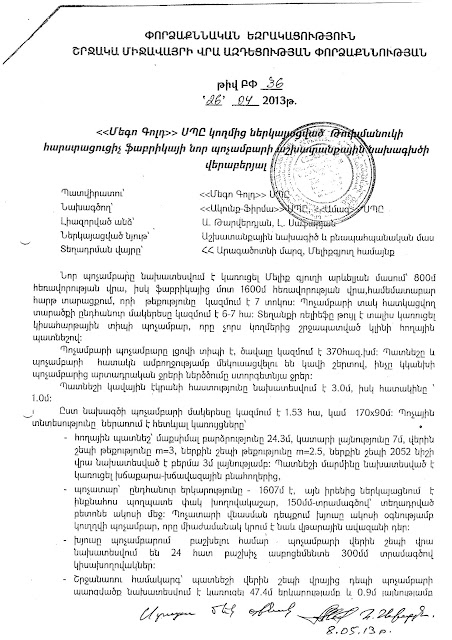

A copy of the original Decision in the Armenian language, signed by the Minister of the MNP, Mr. Aram Harutyunyan, is posed below:

About this Blog: Between 2009 and 2012 I was an active investor in the mineral exploration sector in the Republic of Armenia. Our main project in Armenia was the MARJAN polymetallic gold and silver project located in near Sissian. My JV partner, Mr. Van Z. Krikorian, President of Global Gold Corp (otcqb: GBGD) and Trustee of the Armenian Assembly of America, used corrupt means including using his influence with the US EMBASSY in YEREVAN to secure an indictment against me for theft of the JV and to corrupt the Armenia judicial system to give him a favourable ruling.

Mr. Van Z. Krikorian is the President, CEO and Legal Counsel of Global Gold Corp. (otcqb:GBGD), a penny stock listed on the OTC markets. His public filings with the US Securities and Exchange Commission fail to fully disclose the reality on the ground in Armenia in the promotion and development of GBGD's gold project, the TOUKHMANUK GOLD MINE.

This blog is an effort to bring transparency of the activities of Global God Corp. (otcqb: GBGD) and Mr. Van Z. Krikorian in Armenia.

For your information I have made an unofficial translation of the conclusion of the decision which states:

Again, this Decision was issued April 26, 2013 and GBGD has been keeping it a big secret and has not filed any timely disclosure reports on this matter.Basis of the expert conclusion

‐ Missing in the work plan are the community’s decision and approval of the work plan in their region and the community’s decision on allocating the land as per sub-articles E and Z of article 6 as per RA law regarding “the expert analysis on the effect on the environment”.

‐ The Company should have also presented their mining plan as well as the factory’s renovation plan.

‐ Missing is the tailings dam’s security certificate as required by RA law.

‐ Landslide bodies are present in the tailings dam’s location as per the studies conducted by the Japanese company.

‐ Missing in the plan is also the replacement of the clay layer by a polyethylene membrane as required by RA law.

Conclusion:

Taking into account the above-mentioned results, we reject «Mego Gold» LLC’s working plan for the building of a new tailings dam at the Toukhmanuk factory.

Vice-director: H. Grigoryan

Expert: L. Balayan

Signed

stamped

Under US Securities and Exchange Commission rules, GBGD must timely disclose all material events under form 8-K. Also all material information must be included in their quarterly financial reports.

The rules require that public companies issue material disclosure reports within 4 business days of such events. GBGD should have filed an 8-K report no later than Friday May 3, 2013. Mr. Van Z. Krikorian has breached these regulation. You would think investors should know that the tailings dam application was rejected, and rejected for some very serious reasons too."Form 8-K

In addition to filing annual reports on Form 10-K and quarterly reports on Form 10-Q, public companies must report certain material corporate events on a more current basis. Form 8-K is the “current report” companies must file with the SEC to announce major events that shareholders should know about"....."Companies have four business days to file a Form 8-K"...

http://www.sec.gov/answers/form8k.htm

To make maters worse for GBGD, they had a chance to disclose this matter in their 10-Q filing for the period ending March 31, 2013, which was filed on May 20, 2013.

All that GBGD reported in their 10-Q, filed on May 20, 2013 was:

The Company's expected plan of operation for the calendar year 2013 is:

(a) To implement the joint venture agreement with Consolidated Resources USA, LLC, and build a new tailings dam necessary to recommence operating expanded mining operations at Toukhmanuk, to generate income from offering services from the ISO certified lab operating at Toukhmanuk, and to continue to explore this property to confirm and develop historical reserve reports, to explore and develop the Getik property in Armenia;

http://www.sec.gov/Archives/edgar/data/319671/000143774913006451/ggc_10q-033113.htm

Clearly Global Gold has failed to timely

file an 8-K on material event. The inability of GBGD to secure a permit

for a tailings dam is a material event that further delays the financing and commencement of mining of the Toukhmanuk Gold Mine and ultimately affects the valuation of

the Company.

GBGD has been misleading investors on issues related to the tailings dam at the TOUKHMANUK GOLD MINE for some time now. GBGD claims in its 10-K for the period ending December 31, 2012, filed on April 16, 2013, that:

As of December 31, 2012, the Company has spent approximately $11,130,000 on mining and exploration activities at this property, excluding acquisition and capital costs. In 2012, the Company installed two new mills at the plant to increase capacity and efficiency, but did not process any ore pending approval and construction of a new tailings dam and resolution of joint venture issues. http://www.sec.gov/Archives/edgar/data/319671/ 000143774913004481/gbgd_10k- 123112.htm

Furthermore, Global Gold has been talking about building a new tailings dam at the TOUKHMAUK GOLD MINE since 2008. In its 10-K/A report for the period ending December 31, 2008, GBGD states:

The Company has maintained the plant’s crushers, mills, and gravitation circuits are in good condition while also adding a hydro cyclone, flotation cells, and building a new tailings dam. http://www.sec.gov/Archives/edgar/data/319671/ 000143774910000448/globalgold_ 10ka-123108.htm

GBGD needed to build this new tailings dam since 2008. Due to apparent mismanagement at the company, it still has not been done.

Clearly the lack of disclosure is designed

to mislead investors that there is no issue with the tailings dam,

considering the Management is aware there are serious issues in securing

the tailings dam permit, including its inability since 2008 to secure a

proper "Land Use Agreement" and get local community support for the new

tailings dam.

This is just a continuation of a pattern of

misleading and false statements that Global Gold management,

orchestrated by Mr. Van Krikorian, Mr. Ashot Poghossyan and Mr. Jan

Dulman to hide what really is going on in Armenia, in apparent effort to

attempt to conceal the value, or lack thereof, of the TOUKHMANUK gold

mine and ultimately the share price of GBGD. Hiding this information was useful to swindle CRA into investing

$5MM in Mego-Gold. Money advanced by CRA included $260,000 in tailings

dam design and construction, as outlined in the budge below. That money was advanced by CRA in 2011 to

Global Gold but this money was misappropriated because as of today,that tailings dam has not been built.

Also the GBGD has failed to fully disclose that it has lost its exploration license to the Toukmanuk area. See my blog: http://gbgd-armenia-mining.

Also the GBGD has failed to fully disclose that it has lost its exploration license to the Toukmanuk area. See my blog: http://gbgd-armenia-mining.

The pattern of deceit actually starts in 2008 when GBGD falsely stated that the Company is required to mine 80,000 tones per year of ore to keep the Toukhmanuk license in good standing. The truth finally was disclosed by GBGD in its 10-K for the period ending December 31, 2012 as filed on April 16, 2013.

The 10-K now states

"The Company is required to pay annual governmental fees of approximately $32,000. The Company is also required to spend annually approximately $1,200,000 on exploration work and mining annually 168,500 tonnes of mineralized rock at the property as submitted and approved in its mining plan in order to maintain the licenses in good standing"

This is a big jump from 80,000 tpy to 168,500 tpy and a big mistatement.

There

are other examples of this in GBGD's SEC statements, including the recent

discovery that GBGD has been keeping two separate books of mining at

Toukhmanuk, over reporting production by 104% since 2006. See my blog: http://gbgd-armenia-mining.

The actions of Mr. Van Krikorian and GBGD or lack thereof should be investigated by SEC Enforcement and the Public Company Accounting Oversight Board (PCAOB).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.